Kansas's real estate licensing process isn't as complicated as you might think. There are a few things you must do before you can get your license. The first step is to complete the pre-licensing course. You can complete the course online or in class. This course covers fundamental real estate principles as well as information about daily life of a real-estate agent. You also need to pass the exam.

The next step is to submit an application for your license. An authorized Kansas broker must sign the application. A resume should also be included on the application. The application will include a resume. If you're applying to become a branch brokerage, you must show proof of your involvement in real estate for at minimum two years.

Supervising brokers must provide a copy to applicants who work under them. Non-residents must submit a form that demonstrates that they have a valid real estate license in another state. You must have completed 60 hours of pre-licensing education.

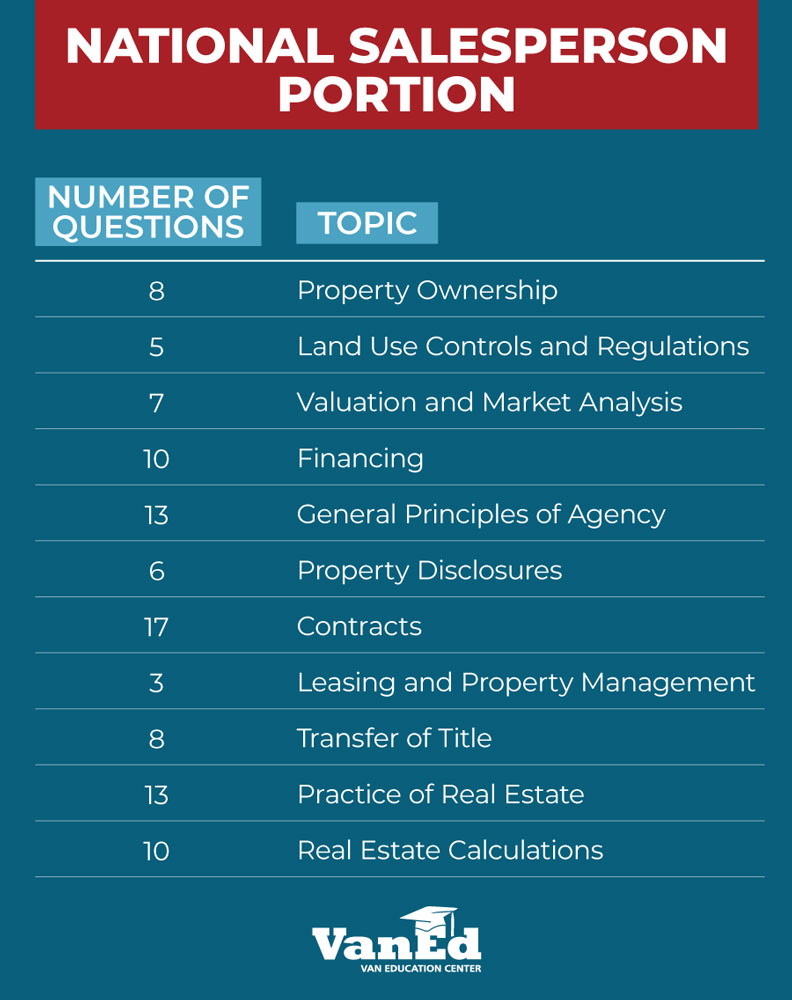

The exam is administered by the Kansas Real Estate Commission. It has a separate national and state portion. The state portion must be completed within six months from the date you submit your application for your license. Alternatively, if you have a current salesperson's license in another jurisdiction, you do not need to complete the national portion of the exam.

Candidates will then need to submit the fees for the exam and the supporting documentation. In the event that you fail to pass any section of your exam, you'll need to retake it. To schedule your reexam, you can wait up until 24 hours after the exam has been completed. You will need to pay the $82 fee for the exam.

After taking the exam, you'll receive your score reports. After receiving your score report, you must apply for your license within six month. You will need to complete a criminal history check if you have a criminal record. Additionally, you will be required to complete an Offense Reporting Formula. You will also need to submit your fingerprint cards. You can apply for fingerprint cards at licensing exam centers.

The background report will be reviewed by the Kansas Real Estate Commission. If they find any violations, they will make disciplinary calls. In certain cases, your license might be denied. You might not be granted a license if you have a violent or financial criminal record. Your license can be suspended or revoked.

License requirements are detailed at the Kansas Real Estate Commission. Their website has more information. You will need to have a high school diploma, and you must be at least 18 years old. You will also need a Kansas-licensed supervising broker.

FAQ

What should I look for in a mortgage broker?

A mortgage broker is someone who helps people who are not eligible for traditional loans. They work with a variety of lenders to find the best deal. This service may be charged by some brokers. Others offer no cost services.

How can I fix my roof

Roofs can leak due to age, wear, improper maintenance, or weather issues. Minor repairs and replacements can be done by roofing contractors. Contact us to find out more.

Do I need flood insurance?

Flood Insurance protects you from flooding damage. Flood insurance helps protect your belongings and your mortgage payments. Learn more about flood coverage here.

Is it possible to quickly sell a house?

It may be possible to quickly sell your house if you are moving out of your current home in the next few months. Before you sell your house, however, there are a few things that you should remember. First, find a buyer for your house and then negotiate a contract. You must prepare your home for sale. Third, your property must be advertised. Lastly, you must accept any offers you receive.

What are the benefits of a fixed-rate mortgage?

With a fixed-rate mortgage, you lock in the interest rate for the life of the loan. This ensures that you don't have to worry if interest rates rise. Fixed-rate loans also come with lower payments because they're locked in for a set term.

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate loans tend to carry higher initial costs than adjustable-rate mortgages. If you decide to sell your house before the term ends, the difference between the sale price of your home and the outstanding balance could result in a significant loss.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to Find an Apartment

The first step in moving to a new location is to find an apartment. This takes planning and research. This includes researching the neighborhood, reviewing reviews, and making phone call. This can be done in many ways, but some are more straightforward than others. Before renting an apartment, it is important to consider the following.

-

Researching neighborhoods involves gathering data online and offline. Online resources include Yelp. Zillow. Trulia. Realtor.com. Online sources include local newspapers and real estate agents as well as landlords and friends.

-

Read reviews of the area you want to live in. Review sites like Yelp, TripAdvisor, and Amazon have detailed reviews of apartments and houses. You can also check out the local library and read articles in local newspapers.

-

Make phone calls to get additional information about the area and talk to people who have lived there. Ask them about their experiences with the area. Ask for their recommendations for places to live.

-

Be aware of the rent rates in the areas where you are most interested. If you think you'll spend most of your money on food, consider renting somewhere cheaper. However, if you intend to spend a lot of money on entertainment then it might be worth considering living in a more costly location.

-

Find out about the apartment complex you'd like to move in. It's size, for example. How much does it cost? Is it pet friendly What amenities does it offer? Can you park near it or do you need to have parking? Do you have any special rules applicable to tenants?