Anybody who wants to sell or buy a home can use a real estate agent as a resource. Not only can they handle the transaction but they also have the ability to help their clients find rental properties. Illinois might be a good place to start your career in realty. It is home to almost 13 million residents and its housing market is booming. The state's housing inventory saw an increase of 15% in sales in 2019. You should still be cautious before entering this business.

First, you need your license. This can be done as an independent contractor or with a brokerage. You can choose to work independently or with a brokerage. However, you will need to invest some time in learning the business and building client relationships. The good news is you can maximize your profits, and minimize your risks.

A licensing test is an important step. Learn about the licensing requirements and the regulations that govern the field. This can be quite a hassle, but it is actually very simple.

The best way for most people to obtain a license in real estate is to enroll in a local accredited school. Many schools offer online classes, which makes it much easier for busy people to learn.

There are a few requirements to become an agent in real estate. In particular, you'll need to complete 75 hours of pre-licensing coursework. The course should consist of at least 60 classroom and 15 interactive practice hours. If you have the patience and time, you can also choose to self-pace your course.

There are many online courses in real estate that you can choose from. These programs can be used to get you licensed quicker. They even have some of the most affordable prices around.

The Illinois real estate license is a different beast than in many other states. You will need to have a Social Security Number and a GED. In addition, you'll need to prove you have completed four semesters of post-secondary education. Additionally, you must complete 45 hours of post licensing training.

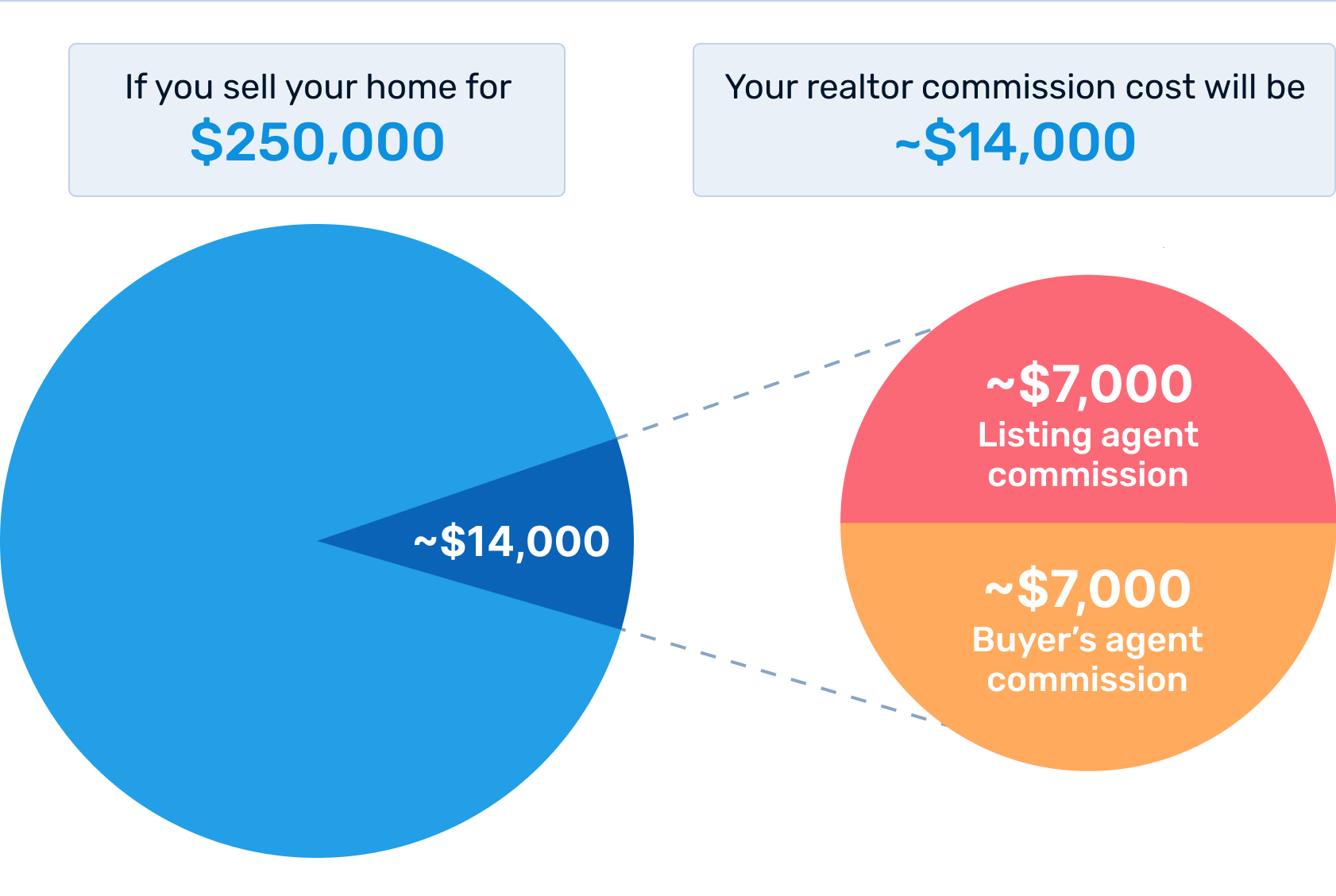

An agent who specializes in real estate can be an asset to the customer, as the average cost of a home is $18,000. You might not make a lot of money at the beginning, but you will see an increase in your clients and your experience. Your earnings will depend on what properties you sell. You can maximize your earning potential by getting a broker's licence.

You should do your research before applying for your real-estate license. You should do your homework to learn more about the state's laws regarding real estate, as well as research prospective brokers to make sure that you're in the right place.

FAQ

Is it possible to get a second mortgage?

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

What are the benefits associated with a fixed mortgage rate?

Fixed-rate mortgages lock you in to the same interest rate for the entire term of your loan. This means that you won't have to worry about rising rates. Fixed-rate loan payments have lower interest rates because they are fixed for a certain term.

What are the top three factors in buying a home?

The three most important factors when buying any type of home are location, price, and size. Location is the location you choose to live. The price refers to the amount you are willing to pay for the property. Size refers to how much space you need.

How do I know if my house is worth selling?

It could be that your home has been priced incorrectly if you ask for a low asking price. A home that is priced well below its market value may not attract enough buyers. Our free Home Value Report will provide you with information about current market conditions.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How to Find an Apartment

When moving to a new area, the first step is finding an apartment. This involves planning and research. This involves researching and planning for the best neighborhood. There are many ways to do this, but some are easier than others. Before renting an apartment, it is important to consider the following.

-

Data can be collected offline or online for research into neighborhoods. Online resources include Yelp. Zillow. Trulia. Realtor.com. Online sources include local newspapers and real estate agents as well as landlords and friends.

-

Find out what other people think about the area. Yelp and TripAdvisor review houses. Amazon and Amazon also have detailed reviews. You can also find local newspapers and visit your local library.

-

Call the local residents to find out more about the area. Talk to those who have lived there. Ask them what they loved and disliked about the area. Ask if they have any suggestions for great places to live.

-

Consider the rent prices in the areas you're interested in. You might consider renting somewhere more affordable if you anticipate spending most of your money on food. However, if you intend to spend a lot of money on entertainment then it might be worth considering living in a more costly location.

-

Find out about the apartment complex you'd like to move in. Is it large? What price is it? Is it pet-friendly What amenities are there? Are there parking restrictions? Do tenants have to follow any rules?