A typical New York real estate commission is split evenly between the buyer's and listing agents. This means that the buyer's and listing agents earn 3% each, respectively. There may be no buyer's representative in certain cases and the listing agency collects the full 6 percent commission. It is estimated that over 95% of listings in NYC are sold through agents. The seller signs a contract usually with the agent listing the property.

Flat fee

The real estate market in New York is unique compared to other parts of the country. Sometimes you will see listings with "No Fee" or 'No Broker's Fee". However, if you rent an apartment, the agent will need to be paid anywhere from 8% up to 15% of the annual rent. New York's average real estate agent commission rate is 12%. Saving thousands of dollars can be achieved by avoiding paying commissions.

Are you buying or selling a property? Usually, the seller pays the fee at the closing. The commission is waived if the home is being sold "For Sale by Owner". A flat fee will be charged to have your listing on the local MLS. The flat fee listing will include contact information for the seller and show instructions.

Brokerage fees

The Consumer Federation of America published a report about the differences in New York City's real estate commission rates. The report found huge differences in commission rates from one area to the next. The typical buyer agent commission rate ranged between 1% and 3% in Brooklyn, while it was 3% in Manhattan. This disparity in total compensation was further magnified by the fact that Manhattan homes were more expensive than Brooklyn.

New York realty agents charge fees which can be negotiated. The standard brokerage fee is 15%. However, buyers and sellers can negotiate a lower price. Brokers will consider a lower fee for those who are fast and have the necessary paperwork. This is because brokers need to know how much competition exists in the area.

Agent dual

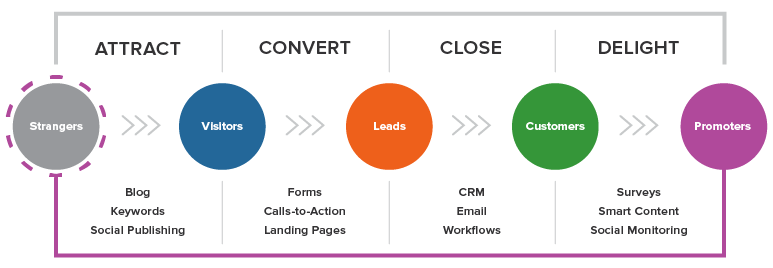

Dual agency, a type in real estate where both the buyer AND seller are represented by a licensed agent, is a legal arrangement. Each party involved has their own pros and cons. It speeds up the transaction process by resolving any issues faster. This arrangement is for buyers and sellers who have lots of experience.

A benefit of dual agency is the reduction in the overall cost of the transaction. Often, a dual agency arrangement can save you around one- to two percent on your commission. This can also allow the parties to have greater negotiation freedom.

FAQ

What time does it take to get my home sold?

It depends on many factors including the condition and number of homes similar to yours that are currently for sale, the overall demand in your local area for homes, the housing market conditions, the local housing market, and others. It can take anywhere from 7 to 90 days, depending on the factors.

How long does it usually take to get your mortgage approved?

It all depends on your credit score, income level, and type of loan. Generally speaking, it takes around 30 days to get a mortgage approved.

How many times do I have to refinance my loan?

It all depends on whether your mortgage broker or another lender is involved in the refinance. In both cases, you can usually refinance every five years.

Is it possible to sell a house fast?

You may be able to sell your house quickly if you intend to move out of the current residence in the next few weeks. You should be aware of some things before you make this move. First, you will need to find a buyer. Second, you will need to negotiate a deal. Second, prepare your property for sale. Third, your property must be advertised. Finally, you should accept any offers made to your property.

Can I afford a downpayment to buy a house?

Yes! There are programs available that allow people who don't have large amounts of cash to purchase a home. These programs include government-backed mortgages (FHA), VA loans and USDA loans. Visit our website for more information.

Are flood insurance necessary?

Flood Insurance covers flooding-related damages. Flood insurance protects your belongings and helps you to pay your mortgage. Learn more about flood coverage here.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to find an apartment?

When you move to a city, finding an apartment is the first thing that you should do. Planning and research are necessary for this process. This involves researching neighborhoods, looking at reviews and calling people. This can be done in many ways, but some are more straightforward than others. These are the steps to follow before you rent an apartment.

-

It is possible to gather data offline and online when researching neighborhoods. Websites such as Yelp. Zillow. Trulia.com and Realtor.com are some examples of online resources. Local newspapers, landlords or friends of neighbors are some other offline sources.

-

Find out what other people think about the area. Review sites like Yelp, TripAdvisor, and Amazon have detailed reviews of apartments and houses. You might also be able to read local newspaper articles or visit your local library.

-

Call the local residents to find out more about the area. Talk to those who have lived there. Ask them about what they liked or didn't like about the area. Ask for recommendations of good places to stay.

-

Check out the rent prices for the areas that interest you. If you are concerned about how much you will spend on food, you might want to rent somewhere cheaper. On the other hand, if you plan on spending a lot of money on entertainment, consider living in a more expensive location.

-

Find out information about the apartment block you would like to move into. Is it large? What's the price? Is it pet friendly What amenities are there? Can you park near it or do you need to have parking? Do you have any special rules applicable to tenants?